WIFIA Benefits and Flexibilities

- I am worried about rising costs.

- I have a “once-in-a-generation” project.

- I need to limit impacts on rate payers.

- I am waiting for grant funding.

- I need to combine multiple sources to fund my project.

- I need to move quickly.

- I can’t get what I need from traditional funding sources.

- I need to address a regional/multi-jurisdictional problem.

- I need help navigating the funding process.

I am worried about rising costs.

Undertaking large water infrastructure projects in the current environment can be challenging as communities face pressure from higher interest rates, construction bid prices, and material costs. Cost uncertainty can make it difficult to get buy-in for large projects and can make planning for them daunting. Concerns about loans and the associated interest rates can deter communities from seeking necessary financing for projects.

How Can WIFIA Funding Help?

Rising costs are valid concerns but do not need to prevent implementing necessary water infrastructure improvements. The WIFIA program has several options to help communities accelerate their water infrastructure projects while mitigating the impacts of rising costs. These benefits provide up-front funding certainty and post-closing flexibility.

- Locked-in Interest Rate: Borrowers lock in their interest rate on the date of loan closing. This is advantageous because it allows borrowers to immediately lock in their rate for the entire multi-year construction project and only draw funds as needed.

- Interest Rate Reset: Even with the locked-in interest rate, borrowers may want additional flexibility, given the ever-changing interest rate environment. If rates go down in the future prior to the WIFIA loan being drawn, borrowers may request a one-time interest rate reset to lower the WIFIA loan interest rate.

- Amortization and Draw Schedule Adjustments: After loan closing, changes during project construction can impact financing plans. Borrowers might be interested in adjusting their loan amortization and draw schedules to address these changes. To maximize flexibility, the WIFIA program offers automatic restructuring of amortization and draw schedules if there are changes to project costs, schedule, or funding sources. This option helps borrowers wrap WIFIA loans around other funding sources and create a flexible repayment schedule that meets their needs.

- Ability to Change Projects Within a Loan: There may be a need to add, drop, or swap projects included in a WIFIA loan due to project cost increases after loan closing. If construction bids come in higher than expected and project changes are necessary, the WIFIA program allows the addition, removal, or swap of projects under the WIFIA loan.

Hear What Our Borrowers Are Saying:“The EPA’s WIFIA Program is an important financing tool as utility agencies nationwide grapple with aging infrastructure,” said San Francisco Public Utilities Commission General Manager Dennis Herrera. “The program’s low, fixed-interest rates and flexible repayment terms help us invest in necessary upgrades to make our systems more resilient, improve seismic safety, and adapt to a changing climate – all while keeping costs down and our rates affordable.”

I have a “once-in-a-generation” project.

Communities across the country are undertaking critical “once-in-a-generation” projects that will modernize water infrastructure, ensure compliance with current and future regulatory requirements, and prepare for the future. These projects are complex and will likely require multiple sources of funding. Given the complexity, communities will spend several years completing project planning, design, and construction. Most importantly, the significant investment needed for “once-in-a-generation” projects will have an immediate impact on current ratepayers.

How Can WIFIA Funding Help?

Using WIFIA program flexibilities can help communities plan for and fund once-in-a-generation projects. By spreading loan payments out gradually over a longer term using WIFIA financing, communities can reduce the impact on current ratepayers while locking in funding, bundling critical projects for accelerated implementation, and providing funding certainty.

The WIFIA program offers several solutions to help communities address these large projects:

- Sculpted Repayment Schedule: Borrowers can customize their repayments to match their anticipated revenues and expenses for the life of the loan. This flexibility provides borrowers with time they may need to phase-in rate increases to generate revenue to repay the loan. The WIFIA program offers repayment terms of up to 35 years after project completion. Borrowers may also defer repayments for up to 5 years after project completion and make interest-only payments for additional years.

- Lock in Funding Early: Communities can lock in WIFIA financing early and all at once, providing funding certainty for critical water infrastructure projects. WIFIA loans can be the first money in the project, without matching funds secured. The WIFIA program offers expeditious loan closing in as little as 4 months (or at the borrower’s preferred speed).

- Project Bundling Options: The WIFIA program has a few options for bundling projects, depending on borrower needs.

- Borrowers can bundle several projects into a single loan (pdf) (337.21 KB). Bundling projects streamlines processes and saves borrowers time and money by only closing one loan, instead of separate loans for each individual project. This option can be extremely advantageous for communities looking to complete large, complex projects.

- The WIFIA program also offers a master agreement (pdf) (418.07 KB), which is an umbrella contract between EPA and a borrower that provides an upfront commitment of loan proceeds and a common set of legal and financial terms under which a borrower can close multiple WIFIA loans over time. Master agreements are helpful for borrowers with several projects that are in different phases, have different schedules, or are in different stages of the environmental review process. By evaluating the credit and negotiating the legal framework upfront, the WIFIA program and the borrower can close each loan under a master agreement faster and for lower cost than multiple loans outside of a master agreement.

- Draw Funds as Needed: WIFIA loans are an “up to” amount, and borrowers are not required to draw down all the funding – only what is needed. This is helpful for borrowers that might secure other funding sources (e.g., grants) after closing the WIFIA loan. There are also no draw requirements, and borrowers can request reimbursement on their schedule. Borrowers can request disbursements as often as once per month but can also request a single disbursement up to one year after project completion.

Hear What Our Borrowers Are Saying:“We are grateful to the EPA for awarding this WIFIA loan to Metro Water Services. The Process Advancements Project at the Omohundro and KR Harrington Water Treatment plants is the result of many years of strategic, long-term planning and this WIFIA loan marks a milestone in making these plans a reality for our community. Proper investment in infrastructure is necessary to ensure Nashville’s ability to provide safe, clean, and reliable water and waste services to our community now and in the future. The Process Advancements Project funded by WIFIA allows MWS to proactively address aging infrastructure, expand capacity, reduce flood risk and incorporate the use of new treatment technologies for enhanced water quality at our water treatment facilities – preparing them for the next generation.” – Scott Potter, Director, Metro Water Services (pdf) (226.27 KB)“It will take us over a decade to plan, design, and construct our regional drinking water infrastructure system. The expenditures will be great, but we are building infrastructure that will last for generations. With our WIFIA loan, we have access to the capital we need when we need it, without accruing interest until funding is needed. Our sculpted WIFIA loan repayment also allows us to spread the costs of the infrastructure over many years without placing undue burden on our current customers. No other financing option could match our project needs and give us this drawdown and repayment flexibility at such a low cost.” – Allison Swisher, Director of Public Utilities, City of Joliet (pdf) (289.48 KB)

I need to limit impacts on rate payers.

Raising water rates is typically unavoidable when paying for water infrastructure projects or capital improvement programs. One option for mitigating these rate increases is securing grants or affordable, low-cost financing. This funding can help moderate water rate increases and limit impacts on rate payers.

How Can WIFIA Funding Help?

The WIFIA program offers several flexibilities to secure debt financing for projects now while minimizing the burden on current ratepayers, including customized repayment schedules and the ability to wrap WIFIA loans around existing debt. These options help accelerate water infrastructure investments, while limiting rate payer impacts.

- Sculpted Repayment Schedule: Borrowers can customize their repayments to match their anticipated revenues and expenses for the life of the loan. This flexibility provides borrowers with time they may need to phase-in rate increases to generate revenue to repay the loan. The WIFIA program offers repayment terms of up to 35 years after project completion. Borrowers may also defer repayments for up to 5 years after project completion and make interest-only payments for additional years.

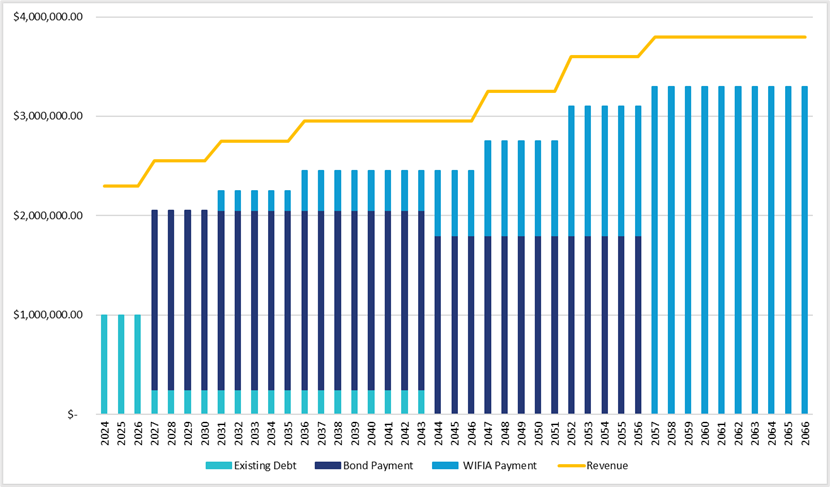

- Wrap WIFIA Loan Around Other Debt: The ability to slowly increase loan payments allows borrowers to wrap principal repayments around other debt. For example, a project co-funded with a 20-year State Revolving Fund (SRF) loan and a 35-year WIFIA loan could take advantage of the WIFIA program’s flexibility and make only minimal payments until year 21, after the SRF loan has been fully repaid.

Hear What Our Borrowers Are Saying:“The WIFIA Program is financing long term water supply reliability and helping the District meet its goal of maintaining water affordability for its customers. The WIFIA Underwriting Team and Portfolio Manager have been extremely helpful and make the process of obtaining a WIFIA loan and disbursements straightforward and customizable based on our specific project.” – Kari Duncan, General Manager, Rockwood Water People’s Utility District (pdf) (234.11 KB)

“WIFIA has helped us manage costs, saving rate payers over $66 million in long-term interest expenses. Working with WIFIA has been easy - the team is incredibly supportive and accessible.” – Seattle Public Utilities (pdf) (243.02 KB)

I am waiting for grant funding.

Over the next 20 years, there will be more than 1 trillion dollars in water infrastructure needs across the country. To address these critical projects, grant funding is typically the first option. However, grant funding is limited, competitive, and can take a long time to reach communities. Given these obstacles, filling gaps with low-cost water infrastructure financing is an alternative option.

How Can WIFIA Funding Help?

The WIFIA program offers several solutions to help communities keep moving forward with their necessary water infrastructure projects, even while seeking or waiting for grant funding. Borrowers can take advantage of efficient co-funding, the option to secure other funding throughout the project, the ability to draw only the funds needed, and no-penalty prepayment.

- Co-funding: The WIFIA program was designed to be a supplemental lender and pair well with other types of water infrastructure financing. WIFIA loans can be co-funded with State Revolving Fund loans, grants, bonds, or cash. Regardless of source and type, the co-funding programs work together to increase efficiency, reduce burden, and maximize benefits to communities.

- Secure Other Funding During the Project: WIFIA borrowers always have the option of securing additional funding sources, even after loan closing. This helps borrowers find the most advantageous funding strategy that works best for them.

- Draw Funds as Needed: WIFIA loans are an “up to” amount, and borrowers are not required to draw down all the funding – only what is needed. This is helpful for borrowers that might secure other funding sources, including grants, after closing the WIFIA loan. There are also no draw requirements, and borrowers can request reimbursement on their schedule. Borrowers can request disbursements as often as once per month but can also request a single disbursement up to one year after project completion.

- No-penalty Prepayment: Borrowers have the option to prepay their WIFIA loans at any time with no penalty. This can help borrowers who secure other funding during the project.

Hear What Our Borrowers Are Saying:"Modernizing our aging water infrastructure is critical to ensuring that the City of Evanston and our more than 400,000 water customers enjoy continued access to safe, reliable, high-quality drinking water amid the ongoing climate crisis. I'm grateful to our federal and state partners for their collaboration and support for this historic infrastructure improvement project." – Daniel Bliss, Mayor, City of Evanston (pdf) (261.69 KB)

I need to combine multiple sources to fund my project.

There is rarely a perfect funding source to solve every water system challenge. Instead, communities typically utilize a variety of funding sources to address their drinking water, wastewater, and stormwater infrastructure needs. These potential funding sources include cash, bonds, grants, and low-cost loans. While multiple funding sources can benefit communities, complications can also arise.

How Can WIFIA Funding Help?

To minimize complications from combining many different funding sources, the WIFIA program works with co-funding entities to create efficient processes for borrowers. Borrowers can take advantage of several WIFIA financing benefits to streamline this process, including the flexibility to co-fund with a wide range of sources, ability to secure funding throughout the project lifecycle, and options to wrap WIFIA loan around other debt and make amortization and draw schedule adjustments. These cooperative efforts reduce burden and maximize community benefits.

- Variety of Co-funding Options: The WIFIA program was designed to be a supplemental lender and coordinates well with other types of water infrastructure financing. WIFIA loans pair well with both short-term construction financing and long-term financing, such as State Revolving Fund (SRF) loans and bonds.

- Secure Other Funding During the Project: WIFIA borrowers always have the option of securing additional funding sources, even after loan closing. This helps borrowers find the most advantageous funding strategy that meets their needs.

- Wrap WIFIA Loan Around Other Debt: Borrowers can customize their repayments to match their anticipated revenues and expenses for the life of the loan. The ability to slowly increase loan payments allows borrowers to wrap principal repayments around other debt. For example, a project co-funded with a 20-year SRF loan and a 35-year WIFIA loan could take advantage of the WIFIA program’s flexibility and make only minimal payments until year 21, after the SRF loan has been fully repaid.

- Amortization and Draw Schedule Adjustments: After loan closing, changes during project construction can impact financing plans. Borrowers might be interested in adjusting their loan amortization and draw schedules to address these changes. To maximize flexibility, the WIFIA program will work with borrowers who request restructuring of amortization and draw schedules if there are changes to project costs, schedule, or funding sources. This option helps borrowers create a flexible repayment schedule that works with other funding sources.

Hear What Our Borrowers Are Saying:“Soquel Creek Water District is impressed with the streamline process that EPA staff has developed for the WIFIA Program. The step-wise process of submitting an initial letter of interest, executing a WIFIA loan agreement, and submitting reimbursement requests- the EPA WIFIA team is truly a partner in helping to get projects funded and built! Recipients of the program I’m sure aren’t just thankful for the millions upon millions that get loaned out through the WIFIA Program, but it’s also the ease of the administration for borrowers that should also be recognized.” – Eileen Eisner Streller, Assistant Engineer II, Soquel Water Creek District (pdf) (233.79 KB)

I need to move quickly.

Communities often have water infrastructure projects that need to happen as soon as possible and capital improvement plans with multiple projects to complete over the next several years. With all the projects that need to happen, moving quickly is often a top priority. However, navigating various funding programs and their timeframes and requirements can be a challenge and make it difficult to get started on projects.

How Can WIFIA Funding Help?

The WIFIA program has options to move the funding process along as expeditiously as possible, with shorter loan closing timeframes, options for planning and design loans and project bundling, and quick post-loan closing disbursement processes. These flexibilities help accelerate the funding process and water infrastructure projects:

- Expeditious Loan Closing: The WIFIA program moves at the borrower’s speed and will work to close loans that fit the borrower’s schedule. Historically, the WIFIA program has been able to close loans in as little as 4 months from application submission.

- Planning and Design Loans: It can sometimes be difficult for communities to secure funding for projects that are in the conceptual phase. To address this, the WIFIA program offers planning and design-only loans. These loans can help borrowers move forward with projects at a quicker pace. Several WIFIA borrowers have taken advantage of planning and design-only loans to conduct preliminary analyses and evaluate alternatives for their water infrastructure needs.

- Project Bundling Options: The WIFIA program has a few options for bundling projects, depending on borrower needs and timeframes:

- Borrowers can bundle several projects into a single loan (pdf) (337.21 KB). Bundling projects streamlines processes and saves borrowers time and money by only closing one loan, instead of separate loans for each individual project. This option can be extremely advantageous for communities looking to complete a large, complex projects.

- The WIFIA program also offers a master agreement (pdf) (418.07 KB), which is an umbrella contract between EPA and a borrower that provides an upfront commitment of loan proceeds and a common set of legal and financial terms under which a borrower can close multiple WIFIA loans over time. Master agreements are helpful for borrowers with several projects that are in different phases, have different schedules, or are in different stages of the environmental review process. By evaluating the credit and negotiating the legal framework upfront, the WIFIA program and the borrower can close each loan under a master agreement faster and for lower cost than multiple loans outside of a master agreement.

- Efficient Post-Closing Reimbursement: After loan closing, borrowers have the option of requesting reimbursement as frequently as once per month. Upon receiving a complete reimbursement request, the WIFIA program disburses funds within 15 days. Additionally, invoices submitted during reimbursement can be “approved to pay” and don’t need to be paid in advance. These benefits get borrowers money when they need it and help progress their projects.

Hear What Our Borrowers Are Saying:“EPA staff were very helpful from the application phase through implementation and helped save the City time and reduce project costs. The City certainly encourages other utilities to give it a shot.” – City of Beaverton (pdf) (243.13 KB)

I can’t get what I need from traditional funding sources.

There are many options for funding water infrastructure projects, and each option has different benefits, timelines, and requirements. It can be challenging to navigate these various requirements and determine which option best meets the community’s needs. Furthermore, more customized funding options may be possible but often cost the community more money through additional fees or increased interest rates.

How Can WIFIA Funding Help?

The WIFIA program offers several benefits that aren’t traditionally offered with other financing sources, including low interest rates, customized debt structuring, and post-loan closing flexibilities – all available to borrowers without increasing their interest rate. These options provide borrowers with creative, affordable options they might not find elsewhere.

- Interest Rate Set to AAA Treasury Yields: Regardless of the borrower’s investment-grade credit rating, WIFIA interest rates are solely determined by the Treasury rate on the date of loan closing. This benefit saves many borrowers money compared to rates they might receive in the bond market.

- Interest Accrual Flexibility: A WIFIA loan is a cost-reimbursement loan. Interest does not accrue until the borrower draws against the loan. Once incurred costs are reimbursed, the borrower will start to accrue interest, but only on the amount of money disbursed. This is a meaningful benefit to WIFIA borrowers because disbursements can be requested and interest accrued only when funds are needed.

- Works Within Existing Debt Structures: In most cases, the WIFIA program can work within a borrower’s existing debt structure and provide loan structuring flexibility. As long as other project debt is on a subordinate lien, the WIFIA loan can also be placed on a subordinate lien at the same price as a senior lien. Furthermore, the WIFIA program can work with the borrower to slot the WIFIA loan within the borrower’s existing indenture, simplifying debt monitoring. The WIFIA program can accept multiple types of revenue pledges, including system revenues, general obligation bonds, or taxes.

- Amortization and Draw Schedule Adjustments: After loan closing, borrowers might be interested in adjusting their loan amortization and draw schedules to address schedule or project changes. The WIFIA program will work with borrowers who request restructuring of amortization and draw schedules if there are changes to project costs, schedule, or funding sources. This option helps borrowers wrap WIFIA loans around other funding sources and create a flexible repayment schedule that meets their needs.

Hear What Our Borrowers Are Saying:“Silicon Valley Clean Water is grateful for the EPA’s partnership in helping to finance one of the largest infrastructure projects in history by a local Bay Area agency. Our ratepayers benefit from the low interest rates and flexible debt structures offered by the WIFIA Loan program.” – Alicia Aguirre, Chairperson, Silicon Valley Water District (pdf) (255.30 KB)

I need to address a regional/multi-jurisdictional problem.

Some water challenges, like drought, have broad impacts that affect entire regions of the country. Tackling the problem at a regional level provides for more holistic and long-term solutions versus each individual community trying to solve the problem alone. However, it can be difficult to find funding for a regional entity, while also addressing the needs of the individual communities within the region.

How Can WIFIA Funding Help?

The WIFIA program can provide financing to help scale regional solutions through the ability to fund a wide range of borrowers and projects and work within a variety of legal structures. Furthermore, borrowers have the option to bundle projects over a longer timeframe.

- Wide Range of Eligibilities: The WIFIA program can provide funding to public and private borrowers, including public-private partnerships, joint powers authorities, and other unique entities. WIFIA funding may be used to pay for planning, design, construction, and some financing costs. Borrowers can also use WIFIA funding to address multiple types of projects at once (e.g., wastewater and stormwater). This wide range of eligibilities makes it easier for regional entities to receive WIFIA funding for several projects across the region at once, limiting the need for communities to individually seek funding for smaller-scale projects.

- Legal Structure Flexibility: The WIFIA program can also work within a variety of legal structures between the regional partners. This flexibility allows the WIFIA program to fit into the framework that works best for the partners, including lending to multiple agencies for the same project, lending to regional authorities, or lending to special purpose vehicles created for single project purposes, all of which save time and money for the communities.

- Expanded Project Costs Percentage: The WIFIA program can fund up to 49% of a borrower’s project costs (or up to a maximum of 80% for small communities of 25,000 or less people). Multi-jurisdictional entities comprised of small and large borrowers are eligible for loans of more than 49% of project costs (based on the small member(s) pro-rata share).

- Project Bundling Options: The WIFIA program has a few options for bundling projects, depending on the regional entity’s needs.

- Borrowers can bundle several projects into a single loan (pdf) (337.21 KB). Bundling projects streamlines processes and saves borrowers time and money by only closing one loan, instead of separate loans for each individual project. This option can be extremely advantageous for communities looking to complete large, complex projects.

- The WIFIA program also offers a master agreement (pdf) (418.07 KB), which is an umbrella contract between EPA and a borrower that provides an upfront commitment of loan proceeds and a common set of legal and financial terms under which a borrower can close multiple WIFIA loans over time. Master agreements are helpful for borrowers with several projects that are in different phases, have different schedules, or are in different stages of the environmental review process. By evaluating the credit and negotiating the legal framework upfront, the WIFIA program and the borrower can close each loan under a master agreement faster and for lower cost than multiple loans outside of a master agreement.

Hear What Our Borrowers Are Saying:“Receiving these WIFIA loans is a game-changer for the residents of Polk County. The PRWC alliance formed between the county and its municipalities has strengthened our opportunity to seek federal and state funding that will have tremendous impact on future water supplies in Polk.” – George Lindsey III, Chairman of the Board of Directors, Polk Regional Water Cooperative (pdf) (299.90 KB)

I need help navigating the funding process.

Outside funding is typically needed to address large water infrastructure projects, but navigating the funding process can be daunting. Unless there are staff dedicated to securing and complying with funding requirements, communities might decide to defer projects until a later date. Postponing projects can be risky and lead to larger, more complex projects in the future.

How Can WIFIA Funding Help?

The WIFIA program can help communities navigate the funding process from beginning to end. The WIFIA team provides comprehensive support during all stages of the process and can also coordinate with other funding programs to streamline processes and eliminate duplicative efforts.

- Wide Range of Eligibilities: The WIFIA program can provide funding to public and private borrowers for their drinking water, wastewater, and stormwater infrastructure projects. WIFIA funding may be used to pay for planning, design, construction, and some financing costs. Borrowers can also use WIFIA funding to address multiple types of projects at once (e.g., wastewater and stormwater). This wide range of eligibilities makes it easier for communities to receive WIFIA funding for all their various water infrastructure needs.

- Dedicated Loan Management Team: The WIFIA team can provide support and technical assistance to communities even before submission of their Letter of Interest. This help continues throughout the project selection, application, loan closing, and post-loan closing processes. Communities have a dedicated team to answer questions and make the process as efficient as possible.

- Coordination with Other Funders: To minimize complications, the WIFIA program works with co-funding entities to create efficient processes for borrowers. For example, the WIFIA program’s environmental team works with other co-funders to determine a lead agency, share documentation, and perform one environmental review, instead of a separate environmental review for each funding source.

- Streamlined Reporting Requirements: The WIFIA program can accept financial, technical, and environmental reporting documentation required for other funding sources. This flexibility saves the community time and resources by limiting the need to generate multiple reports.

Hear What Our Borrowers Are Saying:“WIFIA staff are accessible, knowledgeable, and engaging. Their support made what seemed to be a very daunting process manageable.” – Penny Feist, Assistant Director of Public Works and Utilities, City of Wichita (pdf) (267.91 KB)“The WIFIA engineering, environmental and financial personnel have been extremely helpful in teaming up with DeKalb County to provide safe and reliable water and wastewater services to the community well into the future.” – Michael Thurmond, CEO, DeKalb County (pdf) (243.68 KB)