Green Power Partnership Program Results

Since 2001, the Partnership has made considerable progress in addressing market barriers to green power procurement and use. The GPP brings value to its Partners by offering technical resources and recognizing environmental leadership.

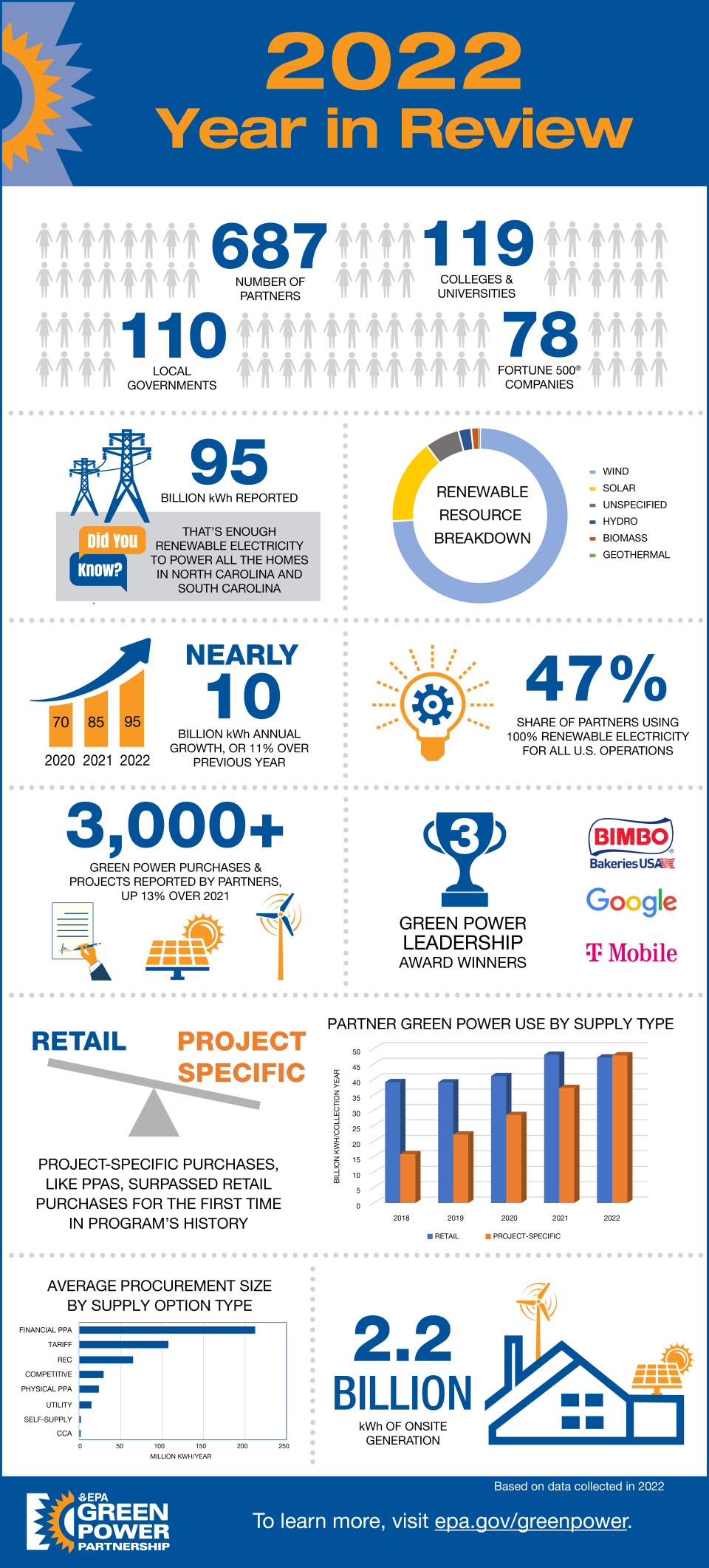

At the end of calendar year 2022, nearly 700 EPA Green Power Partners were using a total of nearly 95 billion kilowatt-hours (kWh) of green power annually, which:

- Is equivalent to the annual electricity use of nearly 8.8 million average American homes. 1

- Represents nearly 35 percent of the total voluntary green power market in the United States. 2

- Represents more than 2.4 percent of total annual retail electricity sales in the United States. 3

To view the Program Data related to the Green Power Partnership, please visit the Program Data Viewer.

Here's an infographic highlighting the Green Power Partnership's 2022 accomplishments.

1 Based on average residential electricity use in 2022. Energy Information Administration's FAQ: How much electricity does an American home use?

2 Relative to total U.S. voluntary green power sales in 2022 as estimated by the National Renewable Energy Laboratory’s Status and Trends in the Voluntary Market report.

3 Relative to total U.S. retail sales of electricity to ultimate consumers in 2022. Energy Information Administration’s Electric Power Annual.